Paytm courts Swiss insurer; Info Edge cofounder on startup IPOs

Also in this letter:

- IPO-bound startups must deliver profits:

Info Edge cofounder - Zostel to approach Sebi with

Oyo IPO complaint - WhatsApp,

Facebook ,Instagram down in major outage

IPO-bound Paytm is in the final stages of talks to bring on board Swiss RE as a strategic partner in its insurance business.

Details: The Zurich-based reinsurance giant is looking to acquire a 20-25% stake in the venture with an initial capital commitment of around $100 million, sources told us. A formal announcement is expected in the coming weeks, they said.

But why? Last July, Paytm announced it was acquiring Raheja QBE, a Mumbai-based general insurance company, from QBE Australia and its 51% domestic partner Prism Johnson of the S Raheja Group for Rs 568 crore.

The acquisition was to be routed through QorQl, of which Sharma owns 51% and Paytm parent One97 Communications the rest. Sharma owns nearly 15% of One97 Communications. However, more than a year later, the acquisition is still awaiting regulatory approval. That’s where Swiss RE comes in.

“Bringing on board a strategic partner at this point will add heft with the regulators. Paytm lacks insurance expertise, which Swiss RE aims to provide,” said an official in the know.

We had reported on July 29 that Sharma was looking at a joint venture for its general insurance business. Raheja QBE, which primarily focuses on corporate covers such as project liabilities, had entered the retail insurance space with auto and health products in February.

Swiss connect: Global reinsurer Swiss RE has had a presence in India since 1998. It established Swiss RE Shared Services (India) in Bengaluru in 2000 and opened a service company in Mumbai in 2002 to provide support for Swiss Re Zurich’s reinsurance activities.

One of world’s largest reinsurers, it had been building a sizable exposure in the Indian life insurance sector through its reinsurance business until 2019. But since 2020 it has reportedly been limiting its reinsurance exposure here as the pandemic brought heavy losses for life insurers in India.

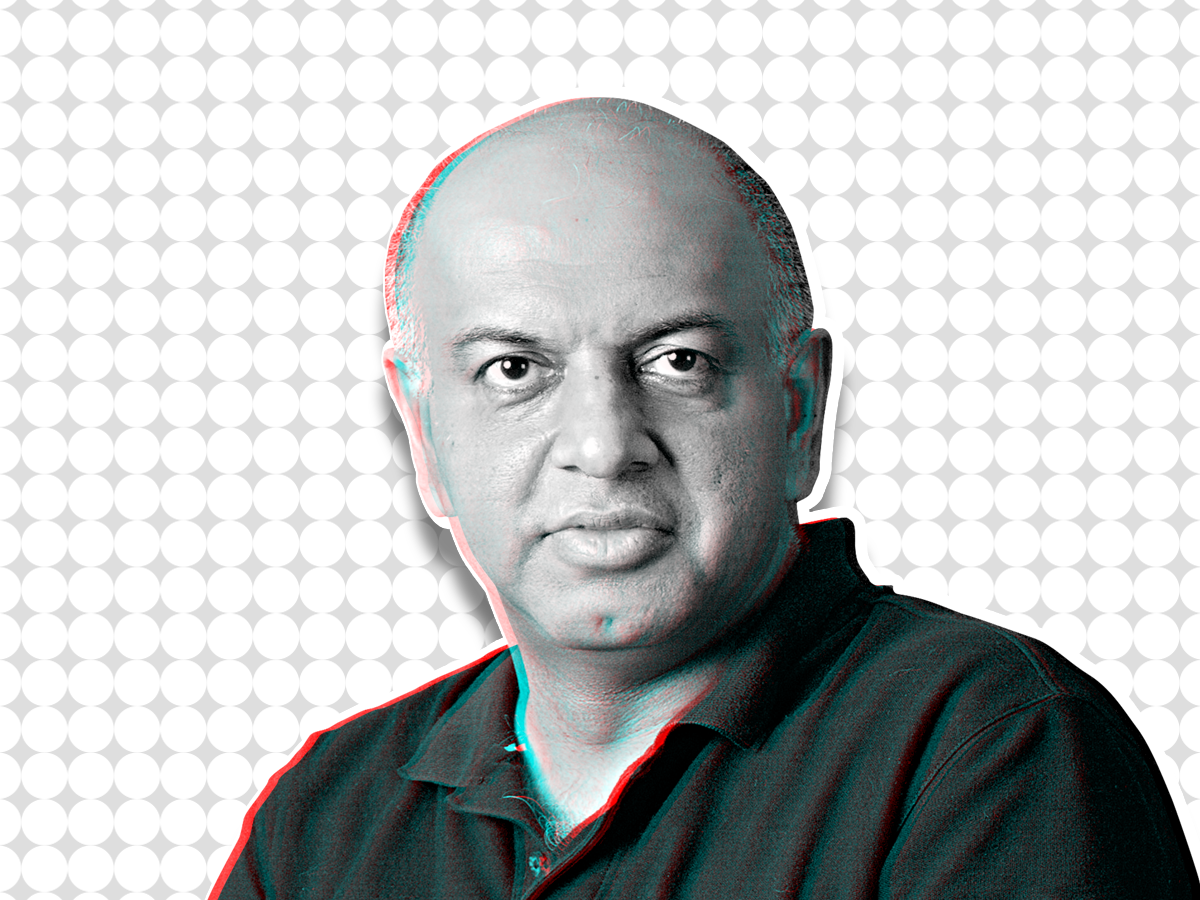

Many IPO-bound startups could be profitable in 2-3 years, says Info Edge cofounder

Info Edge cofounder Sanjeev Bikhchandani told us in an interview that a good number of the current set of IPO-bound startups — whose data he is privy to — could become profitable in the next two to three years. Bikhchandani, who won the Midas Touch award at The Economic Times Startup Awards 2021, said while public markets are now accepting loss-making companies, they won’t keep backing such companies for five or 10 years.

Bikhchandani’s comments on profitability come at a time when a growing number of tech startups that have never turned a profit are going public.

“While public markets are accepting loss-making companies going public, I don’t think they will support a company that’s going to make a loss for the next five or 10 years. They will believe that there is a path to profit,” he said.

Here’s what he told us on a range of other issues:

On long-term investing: He said Info Edge will remain a long-term investor in the startups it is backing. The company still owns more than 15% in Zomato after its initial public offering (IPO). It also remains a shareholder at PolicyBazaar, having invested in the company more than a decade ago. In August, PolicyBazaar filed for a Rs 6,017-crore IPO.

On going public: Bikhchandani said going public is not an option for all startups. “You are going to get to a place where there is some visibility of profit (next two-three years). I don’t know all the data but the ones I know of — definitely (they have a path to profitability).”

Bikhchandani said the current trend of

On the abundance of liquidity: He said India will continue to attract more capital but this has also made him more cautious and selective. He said the excess liquidity is down to the US Federal Reserve’s decision to infuse around $4 trillion into the economy, some of which has found its way to India.

On China’s crackdown: He also said the ongoing regulatory crackdown in China will bring more attention to India. But as a market, India will have its own growth trajectory, different from China’s.

Tweet of the day

Zostel to approach Sebi with Oyo IPO complaint

On Friday, we reported that Oyo had filed its draft prospectus for an initial public offering (IPO) despite a legal challenge from its former rival Zostel (Zo Rooms).

Now, Zostel is planning to move the Securities and Exchange Board of India (Sebi), asking it to put Oyo’s proposed $1.2 billion IPO on hold, two sources with direct knowledge of the matter told us. Zostel is expected to approach Sebi after the Delhi High Court hears their ongoing dispute on October 7, the sources said.

Zostel plans to tell Sebi that Oyo is seeking to raise money from a share sale while an arbitration award is pending in court, in violation of listing regulations. It may also tell the regulator that Oyo hasn’t given the full picture of their dispute in its draft IPO prospectus, our sources said.

Catch up quick: The issue dates back to 2015, when the two companies signed a contract for Oyo to acquire Zostel. The deal fell through, but Zostel said that it still deserved about 7% in Oyo’s parent firm Oravel Stays. A Supreme Court-appointed arbitrator said in March that the term sheet between Oyo and Zo was binding and that Oyo, after a point, stopped taking steps to fulfil obligations under it. It said Zo was “entitled” to make “appropriate proceedings”. Since the dispute landed in court, Oyo has maintained the said term sheet was non-binding and challenged the arbitrator’s order.

Can Sebi halt Oyo’s IPO? Sebi doesn’t give any explicit approvals for an IPO — it just issues an observation letter. If it issues such a letter without any comments, that is considered as a go-ahead.

“Sebi can definitely intervene, which could lead to a delay in the IPO. However, Sebi cannot stop the IPO completely,” said a senior securities lawyer with direct knowledge of the matter. “In the past few months, we have seen Sebi putting several high-profile issuances in abeyance.”

“Sebi can place an IPO in abeyance for up to three months if the investigation is being conducted by Sebi,” said another source. “However, in the current case, proceedings are pending before a high court, hence the IPO can be held back only until the court gives its verdict,” this person added.

Government mulls uniform social media policy

The government has begun discussions on the merits of having a single policy governing all social media companies in the country, top officials told us. They described the intra-ministry talks as preliminary.

Such a policy will include actions such as tagging tweets or media, blocking or suspending accounts, and responding to user requests, the sources said.

Why now? The government’s initiative is being led by a growing perception that internal policies of major social media companies — most of which are headquartered in the US — are “arbitrary” and leading to “online harm” and “discrimination” for users, according to one of the sources.

Quote: “Every user in India has guaranteed fundamental rights. We have the right to not be discriminated against; right to free speech under Article 19 and the right to privacy under Article 21. We cannot allow any platform to strip those rights from users,” a top official told ET.

In the event that a user is blocked by any social media platform, the company cannot be guided only by its own internal guidelines, and “the decision has to pass the test of Article 14 and 19. We have told them (social media platforms) very clearly, as long as you comply with Indian law and respect Indian users, the ministry has no role,” the person added.

Recourse for users: There is also a need also for Indian social media users to have recourse to resolution, they said. For instance, if an account is blocked or a tweet is taken down, users must have avenues apart from courts.

WhatsApp, Facebook, Instagram down in major outage

Facebook went down along with its family of apps including WhatsApp and Instagram just before 9 pm IST on Monday, with thousands of users taking to Twitter to report issues. Facebook acknowledged the issues and said it was working to resolve them.

All three platforms were still down at midnight IST.

“We’re aware that some people are having trouble accessing our apps and products. We’re working to get things back to normal as quickly as possible, and we apologise for any inconvenience,” Facebook posted on Twitter.

Facebook has not yet said what is causing the outages or by when its platforms will be up and running again.

India has more than 410 million users in India, while

Whistleblower revealed: Meanwhile, a whistleblower has accused Facebook of prioritising profit over clamping down on hate speech and misinformation. On Sunday, Frances Haugen revealed herself to be the whistleblower “Sean”.

A product manager who worked for nearly two years on the civic misinformation team at Facebook before leaving in May, Haugen used the documents she amassed to expose how much Facebook knew about the harms that it was causing, and provided the evidence to lawmakers, regulators and the news media.

Exclusive: New investors in talks to join PharmEasy’s pre-IPO round

New investors including hedge fund Steadview Capital, IIFL and a US hedge fund are in talks to join PharmEasy’s pre-IPO funding round, sources told us.

The company has also finalised a secondary transaction of around $100 million in which some existing investors will make a partial exit. These include Infosys cofounder Nandan Nilekani’s venture fund Fundamentum, Eight Roads Ventures and Bessemer Venture Partners.

- In a secondary transaction, existing investors sell some or all their shares to new investors and the money doesn’t go to the company’s coffers. In primary funding, the company gets capital by issuing fresh shares.

US asset manager Fidelity is also in talks with the company to join as its anchor investor during the IPO and plans a sizable investment in the firm, sources added.

Valuation: The pre-IPO funding will take place at a pre-money valuation of around $5.5 billion and the company will be valued at around $5.8 billion after the round, sources said. PharmEasy was last valued at $4.2 billion in June, after it acquired diagnostic lab chain Thyrocare.

We reported in August that PharmEasy had finalised a deadline of October to file its draft IPO papers and had been told it could fetch a valuation of $9-10 billion in a public listing. However, it may price the IPO at a valuation of $7-8 billion so there is an uptick for investors after the listing, we reported last month. These numbers could still change by the time PharmEasy discloses its price band for the offering.

Pre-IPO moves: PharmEasy has received board approval to convert the private firm into a public company. It has also expanded its board to 12 with five new independent directors, including Subramanian Somasundaram, former chief financial officer of Titan, and Ramakant Sharma, founder and chief operating officer of Livspace.

It recently acquired cloud-based hospital supply chain management startup Aknamed for $180-190 million as it continues to position itself as a broader e-healthcare firm.

Byju’s raises $300 million at $18 billion valuation

Byju Raveendran, cofounder, Byju’s

Byju’s has raised around $300 million as part of a larger funding round. Oxshott Capital Partners led the round, in which XN Exponent, Edelweiss, Verition Master Fund, IIFL, and Time Capital Advisors also participated.

The new investment values the company at $18 billion, up from its $16.5 billion valuation in June, which made it India’s highest-valued private

IPO on fast track: We reported last month that Byju’s was in talks to raise $400-600 million and then accelerate plans for an initial public offering (IPO) next year. The company is aiming to file its initial IPO documents as early as the second quarter of next year, having previously looked at a timeline of 12 to 24 months. The startup and its bankers are discussing a valuation of $40 billion to $50 billion, although the final determination will depend on financial results and investor demand.

Acquisition machine: Byju’s has largely fuelled its growth with acquisitions, and spent $2 billion on four companies in six months this year.

■ Fintech startup Progcap has raised $30 million in a Series C round led by existing investor Tiger Global Management and new investor Creation Investments, the firm announced on Monday. Sequoia Capital India, which led the last two funding rounds for Progcap, also participated in the equity round.

■ Insurtech startup GramCover has raised $7 million co-led by Siana Capital and Inflexor Ventures in a Series A round. The fundraise also saw the participation of Stride Ventures along with existing backers Omidyar Network India, Flourish Ventures and Emphasis Ventures (EMVC).

■ Blue-collar workforce management platform Smartstaff has raised $4.3 million in funding from Blume Ventures, Nexus Venture Partners and Arkam Ventures, along with Gemba Capital and some angels. The funds will be used to further enhance the product and build the team.

■ GlobalBees, the direct-to-consumer brand roll up firm from the Firstcry stable, has acquired andMe, a women’s menstrual health, hormonal health, beauty and fitness products maker for an undisclosed amount.

■ IPO-bound digital payments major Paytm has acquired a 100% stake in digital lending startup CreditMate for an undisclosed sum. The founders of CreditMate have sold their stake to Paytm, cofounder and chief commercial officer Aditya Singh said on LinkedIn.

( News Source :Except for the headline, this story has not been edited by Rashtra News staff and is published from a economictimes.indiatimes.com feed.)

Related searches :

![ChatGPT Ghibli Art Generator: Create Studio Ghibli-Style Art with AI [2025] ChatGPT Ghibli Art Generator: Create Studio Ghibli-Style Art with AI [2025]](https://i0.wp.com/www.rashtranews.com/wp-content/uploads/2024/03/thumbnaail.png?resize=330%2C220&ssl=1)